UK construction’s demand for big-volume mineral products like aggregates and concrete showed resilience in the first quarter of 2021, despite renewed lockdown restrictions, Brexit and particularly wet winter weather hampering activity.

That’s according to the latest survey from the Mineral Products Association (MPA) which warns that an encouraging start to the year should not distract from real challenges that lie ahead.

MPA says the recovery in construction must not be taken for granted because so much depends on the Government’s policy stimuli in housing and its delivery of the UK’s planned infrastructure programme. ONS data shows that construction output has flatlined since September, whilst new contract awards have been weak for most of the past year.

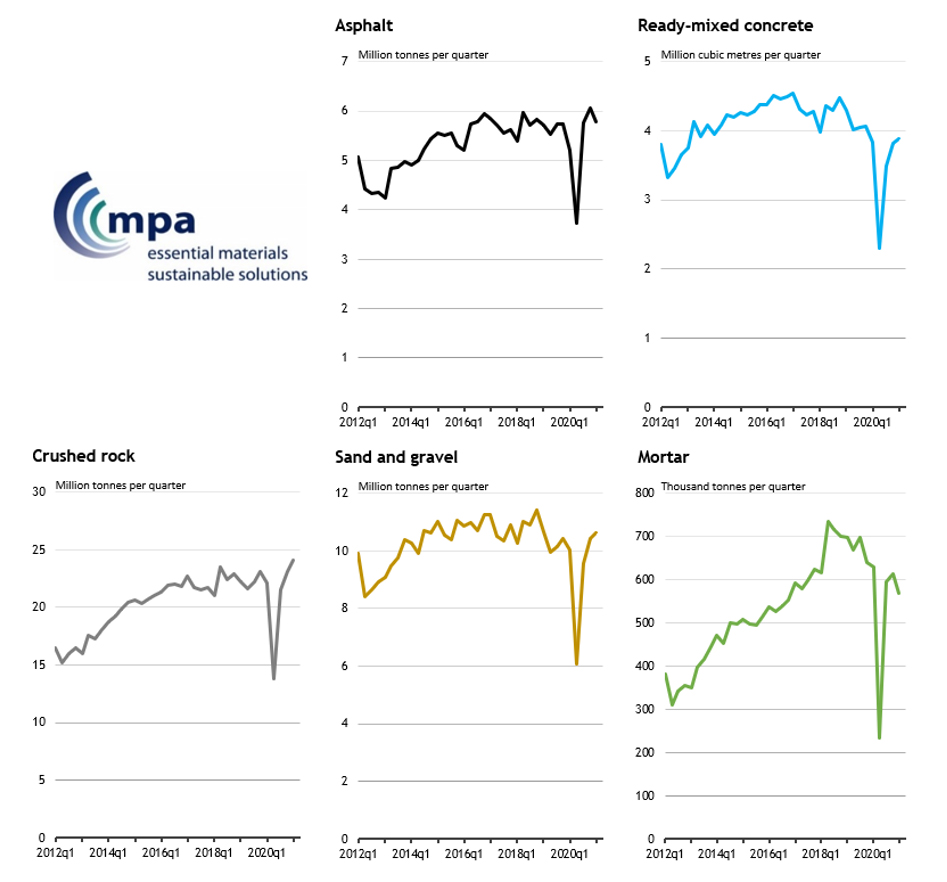

Whilst broadly positive, trends in sales volumes for essential mineral products show mixed results for heavy-side building materials such as aggregates, ready-mixed concrete, asphalt and mortar. These core products are mostly used in the early stages of construction — for example foundations and structures — so their sales provide a unique barometer for the start of new projects rather than the completion of finished ones.

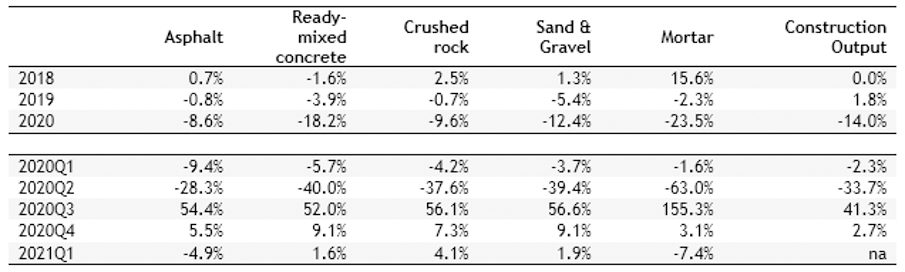

In the latest MPA survey, building materials manufacturers who between them supply around 1 million tonnes of mineral products every day reported a slow but steady start to the year, with construction demand in March much stronger than in January. Sales volumes for primary aggregates and ready-mixed concrete increased by 3.4% and 1.6% respectively in the first quarter of 2021 compared to the last quarter of 2020, but both asphalt and mortar sales volumes declined over the quarter, down 4.9% and 7.4% respectively. Robust housing activity, particularly in landscaping and home improvement, and an acceleration in infrastructure work driven by Highway England’s roads programme and HS2, were tempered by a combination of factors, including supply chain disruptions, rising Covid-19 infections and a particularly wet winter affecting work on site.

Longer-term, recovery for asphalt is supported by renewed momentum in roads construction and maintenance, and market demand has rapidly recovered to pre-pandemic levels. At the start of the year, total sales volumes for asphalt were significantly higher than their previous 5-year average (2014-19). Likewise, sales volumes for crushed rock aggregate have also been recovering well, boosted by roadworks and HS2, which are driving demand for asphalt and bulk fill materials.

The trend for housing-led mortar demand is more ambiguous and producers continue to report uncertainty on the outlook for new housing this year. Mortar sales volumes remain well below pre-pandemic levels and longer-term data indicates that, regardless of the pandemic, mortar demand has been on a steady downward trend since mid-2018. Despite all the talk about recovery, this suggests that housing activity remains dominated by the completion of existing sites ahead of the planned phasing out of the stamp duty holiday and ’Help to Buy’ deadlines, rather than the start of new ones. Volatile new housing contract data in the past year and a subdued overall number of new residential units in the pipeline are expected to weigh on the potential recovery in mortar demand this year.

More concerning is the weak recovery path for ready-mixed concrete, held back by a combination of sluggish new housing activity and a lack of new projects in commercial construction. Over 60% of ready-mixed concrete is used either in new housing or other non-infrastructure projects, mostly in commercial buildings, with London and the South East representing a third of all sales. The total sales volume of ready-mixed concrete at the start of the year remained over 9% below the previous 5-year average, despite three consecutive quarters of growth since last year’s initial lockdown. Looking further back, ready-mixed concrete sales have been subdued since 2017, initially impacted by Brexit-related uncertainty which slowed private sector investment in the commercial sector and triggered a general slowdown in housebuilding. This suggests that the market recovery so far is really just a slow-motion return to growth from a subdued level of activity that pre-dates Covid-19.

Aurelie Delannoy, Director of Economics Affairs at the MPA, said that a balanced perspective is required: “Mineral products manufacturers are busy supplying post- lockdown pent-up demand, particularly for domestic activity such as landscaping, repair and maintenance, and home improvements, as well as infrastructure projects already in the pipeline, including momentum building on HS2.”

“The outlook for this year and next is also positive, but the stakes are high. Any optimism assumes activity is not disrupted by renewed outbreaks of Covid-19, and most importantly, relies on the Government delivering on its planned infrastructure commitments. MPA members tell us they are yet to see a more clear-cut pick-up in new housebuilding, whilst any recovery in commercial development is expected to remain muted given the current reticence for major new investments.”

Nigel Jackson, CEO at MPA, added: “For many of our members, enquiries have been at record levels with some consequential issues relating to haulage availability as well as temporary, localised supply constraints on some products. Brexit-related import delays for spare parts, new lorries and some machinery are also posing a challenge,. Our members are having to adapt quickly to changing market conditions but are generally managing to meet current demand whilst also preparing to ensure future supply. For an industry that is supplying over 1 million tonnes of essential products every day and is the largest supplier to construction, it would be surprising if there were not short-term issues of supply as the economy gathers momentum.”

Figure 1. Mineral products sales volumes in Great Britain

Table 1. MPA sales volumes in GB: change on the previous period (seasonally adjusted)

Note: Ready-mixed concrete includes sales from both fixed and site (mobile) plants.

Source: MPA, ONS.

Ends.