The Mineral Products Association (MPA) has released the results of its latest industry sales survey, revealing a second consecutive annual drop in sales volumes of heavy-side building materials in Great Britain.

The Mineral Products Association (MPA) has released the results of its latest industry sales survey, revealing a second consecutive annual drop in sales volumes of heavy-side building materials in Great Britain.

The deteriorating market for aggregates, concrete, asphalt and mortar has unfolded against a backdrop of unfavourable economic conditions, escalating costs, rising interest rates and a diminishing pipeline of new construction projects.

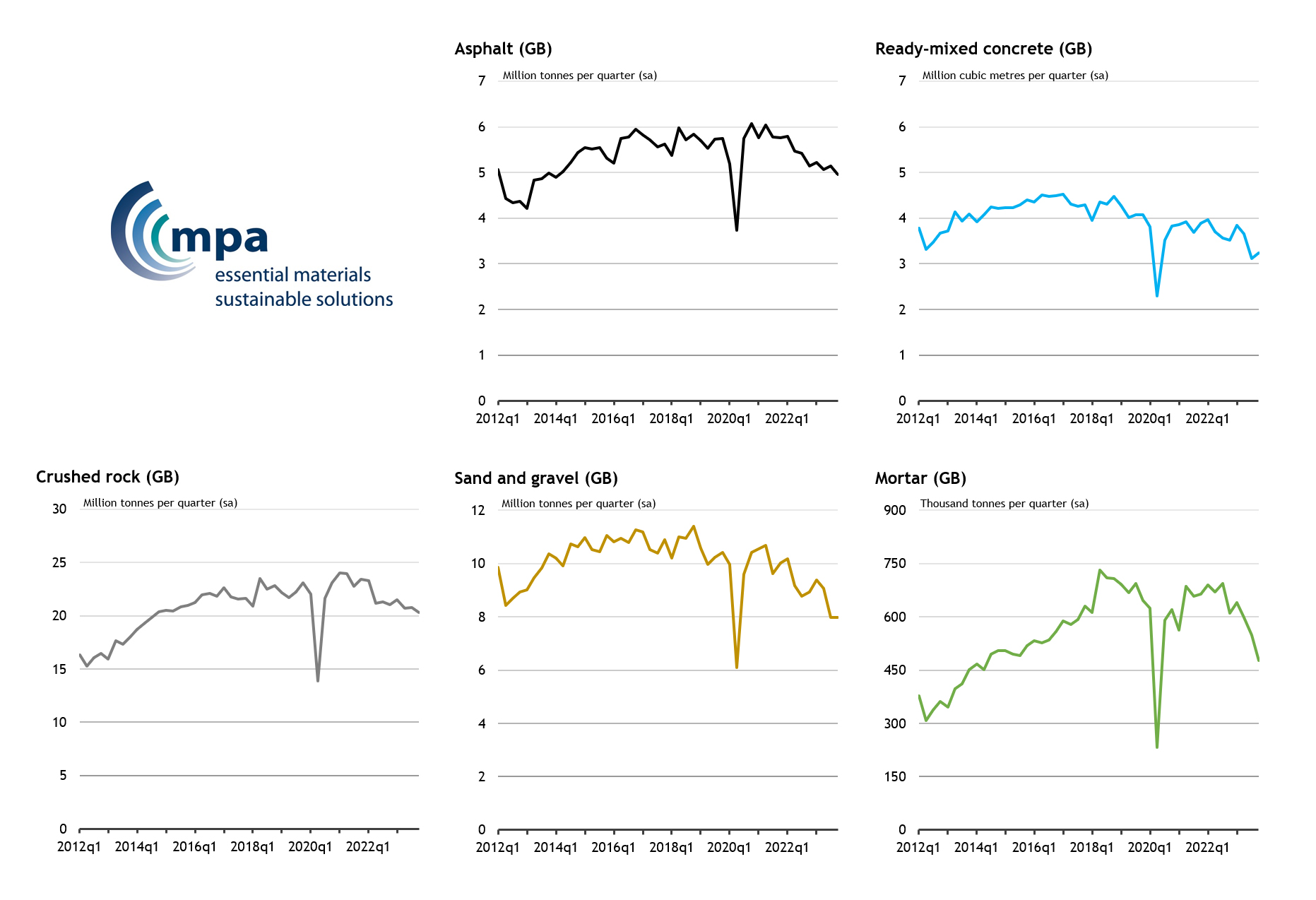

The quarterly survey, an important bellwether of wider construction activity, exposes the challenges faced by producers of heavy-side building materials. Primary aggregates sales volumes in Great Britain recorded a 5% annual decline, ready-mixed concrete dropped by 6.2%, asphalt by 6.6%, and mortar by 15%.

MPA producer members are grappling with a prolonged weakening in demand from the construction industry, with recent months witnessing a noticeable acceleration in the slump, particularly in housebuilding. Sales of mortar, critical for bonding bricks, blocks and masonry, fell by 13.1% in 2023 Q4 alone, reaching 2.3 million tonnes (Mt) in 2023 — 15% lower than in 2022. Official ONS statistics show a 21% decline in total housing output in Britain from October 2022 to November 2023, with mortar sales dropping by 31% over that period.

Demand from other major construction markets is also subdued, particularly from commercial high-rise and highway projects.

Sales of ready-mixed concrete, a staple in construction, declined by 6.2% in 2023 to total of 13.8 million cubic metres. This is the second lowest volume recorded since 1964 - when Harold Wilson became Prime Minister (and “Can’t buy me love” by the Beatles was the top selling single!) The lowest point (13.4 million cubic metres) was in covid-impacted 2020, when the national lockdown resulted in an unprecedented drop in economic activity and industry-wide plant shutdowns for the best part of two months.

The demand for asphalt, split approximately 60/40 between road and non-road construction, dropped by 3.6% in 2023 Q4 and a total of 6.6% for the year, with declines recorded across most regions and devolved administrations in Great Britain. At 20.4 million tonnes, the total volumes of asphalt sales is at a decade low, illustrating the weakness caused by delays and cancellations of National Highways’ road schemes, tight council budgets impacting the delivery of local road upgrades and maintenance, and flagging activity in other areas of construction.

Nonetheless, there are some pockets of growth, driven primarily by on-the-ground progress in major infrastructure projects, including HS2 Phase 1. This has supported demand for primary aggregates as fill materials, although not enough to fully offset the reduction in demand in other markets, resulting in a 5% decrease in total aggregates sales volumes in 2023.

The Government has just published the 2023 National Infrastructure Pipeline, reaffirming the critical reliance on a steady and adequate supply of responsibly-sourced domestic materials such as cement, concrete, aggregates and asphalt.

Expressing concerns about the year ahead, Aurelie Delannoy, Director of Economic Affairs at the Mineral Products Association, said: “MPA producer members’ insight continues to paint a bleak picture for construction in 2024. New projects in the pipeline are stalling due to cost pressures, planning challenges and a poor economic and investment backdrop. This is hitting all facets of new construction work, the most prominent of which has been in private housing. Unfortunately, a meaningful rebound in housebuilding seems elusive at present, amid tight financial conditions for households who are faced with high borrowing costs and reduced affordability.”

As the industry anticipates the Government’s Spring Budget in March, calls for new policy measures to boost UK growth, support business investment and reinforce the infrastructure pipeline become imperative. This was outlined in a recent report by MPA Priorities for the Next Government: Decarbonisation, Growth, Delivery.

Aurelie Delannoy added: “Industry cannot afford to wait for the outcome of the General Election, given the prospect of another year of economic stagnation in 2024 and the deepening challenges for the construction sector and its supply chain. A continued focus on removing barriers to housebuilding should be combined with progress and consistency in the delivery of the existing infrastructure pipeline of projects to pave the way for economic recovery.”

Jon Prichard, Chief Executive of the Mineral Products Association, said: “While we retain confidence in the long-term demand, it is clear that we are facing a significant dip in the market that will be challenging for our members.

“The recent publication of Government’s National Infrastructure and Construction Pipeline is a welcome step in outlining the necessary investments for developing infrastructure essential to energy security, climate adaptation, and the transition to net zero. That said, Government clearly missed an opportunity to enhance the transparency of its commitment by not confirming detailed spending plans beyond 2025, leaving the pipeline as a wishlist of projects.”

Figure 1. Mineral products sales volumes in Great Britain, 2012Q1-2023Q4

Table 1. MPA sales volumes in GB: change on the previous period (seasonally adjusted)

|

|

Asphalt

|

Ready-mixed concrete*

|

Crushed rock

|

Sand & Gravel

|

Mortar

|

|

2021

|

12.5%

|

14.1%

|

16.7%

|

13.3%

|

24.4%

|

|

2022

|

-6.5%

|

-3.8%

|

-7.7%

|

-9.3%

|

3.5%

|

|

2023

|

-6.6%

|

-6.2%

|

-4.1%

|

-7.1%

|

-15.0%

|

|

|

|

2023Q1

|

1.6%

|

9.1%

|

2.2%

|

5.1%

|

4.7%

|

|

2023Q2

|

-3.0%

|

-5.0%

|

-3.7%

|

-3.3%

|

-6.3%

|

|

2023Q3

|

1.5%

|

-14.8%

|

0.2%

|

-12.0%

|

-8.4%

|

|

2023Q4

|

-3.6%

|

4.0%

|

-2.3%

|

0.1%

|

-13.1%

|

* Ready-mixed concrete sales volumes at GB level cover sales from both fixed and site (mobile) plants.

Ends.

About the Mineral Products Association:

The Mineral Products Association (MPA) is the trade association for the aggregates, asphalt, cement, concrete, dimension stone, lime, mortar and industrial sand industries. With affiliation of the British Association of Reinforcement (BAR), the British Calcium Carbonate Federation, the Cement Admixtures Association (CAA), CONSTRUCT, Eurobitume, MPA Northern Ireland, MPA Scotland and the UK Quality Ash Association (UKQAA), it has a growing membership of 520 companies and is the sectoral voice for mineral products. MPA membership is made up of the vast majority of independent SME quarrying companies throughout the UK, as well as the 9 major international and global companies. It covers 100% of UK cement and lime production, 90% of GB aggregates production, 95% of asphalt and over 70% of ready-mixed concrete and precast concrete production. In 2021, the industry supplied £22 billion worth of materials and services to the Economy. It is also the largest supplier to the construction industry, which had annual output valued at £178 billion. Industry production represents the largest materials flow in the UK economy and is also one of the largest manufacturing sectors.

For media enquiries, contact Elizabeth Clements at: Elizabeth.Clements@mineralproducts.org.