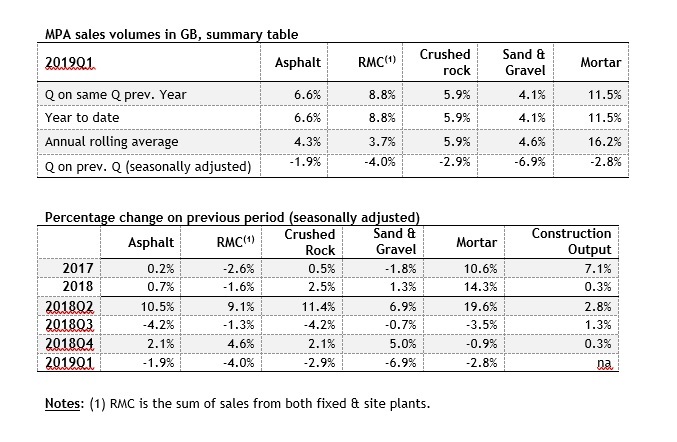

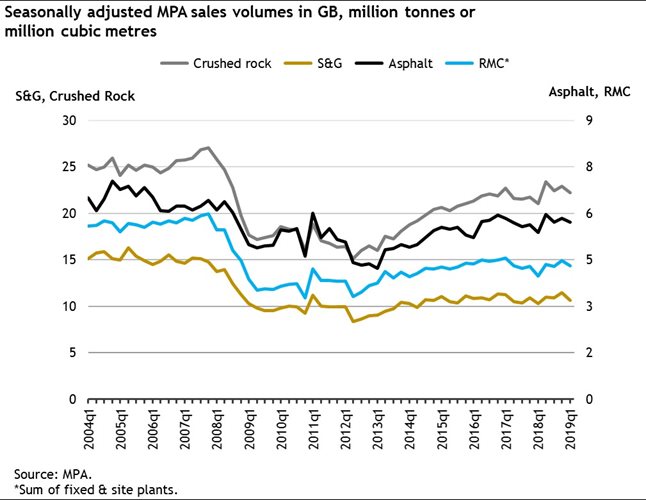

Following an unexpectedly strong performance at the end of 2018, sales volumes of mineral products across markets including aggregates, asphalt, ready-mixed concrete (RMC) and mortar declined in 2019Q1. Seasonally adjusted sales volumes for aggregates had the sharpest decline, down 4.2% compared to the previous quarter, followed by RMC (-4.0%), mortar (-2.8%) and asphalt (-1.9%).

The Mineral Products Association (MPA) results are in line with recently published trends in construction activity. In the three months to February, the Office for National Statistics (ONS) reported that construction output declined 0.6% compared to the previous three months.

The decline in asphalt sales in the first quarter of 2019 is disappointing given the Autumn Budget 2018 commitment of an additional £420m of funding for local road maintenance in 2018/19, which the Department for Transport said last week had all been spent on local authority “general highway maintenance”. Following positive asphalt sales in the fourth quarter of 2018, which may have been impacted by the additional Budget funding, the MPA results do not suggest any significant overall improvement in local road maintenance activity in the first quarter arising from this funding.

Although mortar sales remain at historically high levels, the recent decline in quarterly sales points to a slowdown in housebuilding since mid-2018.

In the longer-term, the trends in mineral products sales suggest nonetheless that markets have remained reasonably robust, as volumes across all materials increased moderately in the 12 months to 2019Q1, compared to the previous 12 months. Aggregate sales were 5.5% higher in the year to March 2019 compared to the previous year, whilst asphalt and RMC sales were up 4.3% and 3.9% respectively. Mortar sales by contrast, closely linked to housebuilding, continued to increase strongly, up 16.2% over the same 12 month period but with sales declining in recent quarters. Whilst the industry will welcome these positive annual results, this includes a strong catch-up effect in 2018Q2, following the major negative impact of the bad weather on the industry’s output early 2018. Therefore, the improved 12 month trends should be viewed in the context of a distorted sales pattern, as the poor 2018Q1 results have fallen out of the current 12 months into the previous 12 months.

Looking ahead, the latest Spring 2019 forecast from the Construction Products Association (CPA) indicates that construction output will be marginally negative this year, before recovering somewhat, albeit slowly, in 2020 and 2021. The medium- term outlook for mineral products and construction markets will depend critically on the speed of delivery of infrastructure projects. For example, Highways England’s national Road Investment Strategy indicates a significant increase in work and investment in 2019/20 and 2020/21 which industry is not only eager to supply but has invested in capacity to do so. However, there continue to be industry reports of major concerns about delays in major road projects, and a clear lack of confidence that the programme will be delivered as planned.

Nigel Jackson, Chief Executive of the MPA commented: “The latest MPA figures confirm that construction activity on the ground has flattened out so far this year as the overall UK economy slows down. There is little doubt about the outstanding need for investment in infrastructure and housing, but private investment throughout the economy, including construction, is being impacted by the current political chaos and economic uncertainty. In addition, whilst Government policy on infrastructure and housing has clearly signalled both a need and desire for higher levels of investment, infrastructure in particular has been characterised by over- promising and under-delivery and there is evidence that housing activity has slowed down.

As the Office for Budget Responsibility forecasts UK economic trend growth at a mere 1.5% on average per annum between 2019 and 2023, it is more important than ever that infrastructure investment is delivered to stimulate the UK’s growth potential. This medium-term GDP growth forecast of 1.5% pa represents an unacceptable outlook for the UK and reflects the complacency and lack of understanding of too many national politicians towards this fundamental national issue. Less growth, ultimately means less tax, less jobs, less investment and less support available for vital public services.”

Ends.